Feeling the Economic Squeeze? Here’s Which Small Business Finance Tools You Can’t Afford to Skip

A grounded guide to staying financially sane when hiring help isn’t on the table.

If the current economy has you side-eyeing every expense, you're not alone. Maybe you’ve paused on hiring. Maybe that big investment you were eyeing is now a “someday.” Maybe you skipped the small business finance tools you saw online and now you’re telling yourself, “I’ll just DIY a little longer.”

I get it. Cash flow is tighter. Uncertainty is real. And sometimes, the smartest move is to hold off on big expenses.

But let me be real with you:

There’s a difference between being lean… and flying blind.

That Time I Tried to Be “Smart” and Made It Harder

A couple years ago, I was trying to be smart with my own expenses. Business was steady but not booming, and I convinced myself that I could skip some of the small business finance tools I usually relied on. I stopped checking my dashboard weekly. I delayed reconciling my books. I figured, “I know this stuff—I’ll just handle it when things pick up.”

Guess what happened?

One unexpected expense hit. Then a quiet month. Then a surprise tax bill I hadn’t planned for because I hadn’t been reviewing my numbers closely. Suddenly I was stressed, reactive, and spiraling into the very financial chaos I help clients avoid.

And I’m a CPA. I know better.

So if you’ve been tempted to cut corners or ignore your numbers because “it’s just a slow season”… I get it. I’ve been there. But it’s not worth it.

The Real Cost of Avoiding Your Numbers

When your finances feel like a black box, it doesn’t just mess with your money.

It clouds your judgment. It fuels anxiety. It makes every business decision feel heavier than it needs to.

Should I raise my prices?

Can I afford to bring on help?

Is this marketing investment even working?

Without data, all you have is guesswork—and that’s not a strategy.

The Truth No One Wants to Say

You don’t have to hire a bookkeeper right now. You don’t need a CFO on retainer.

But you do need a system. One that keeps you grounded, clear, and confident—especially when things feel shaky.

Because when you’re:

Avoiding your bank account

Guessing what you owe in taxes

Making decisions based on vibes, not data

...that’s not scrappy CEO behavior. That’s financial sabotage in slow motion.

What Financial Clarity Actually Looks Like (Even in Hard Seasons)

You know your profit margins, even if they’re smaller right now

You understand your tax obligations and plan for them proactively

You can spot patterns in your income and expenses and make smart decisions accordingly

This isn’t about perfection—it’s about being in the driver’s seat.

Especially when growth feels slow, the last thing you can afford is confusion.

GRAB THIS FREEBIE

The only task tracker designed to help U.S. small business owners finally stay on top of their finances—without missing deadlines, dodging tax bills, or drowning in Google Sheets.

The Small Business Finance Tools I Recommend If You’re Still DIY-ing It

If hiring’s off the table for now, here’s where you start:

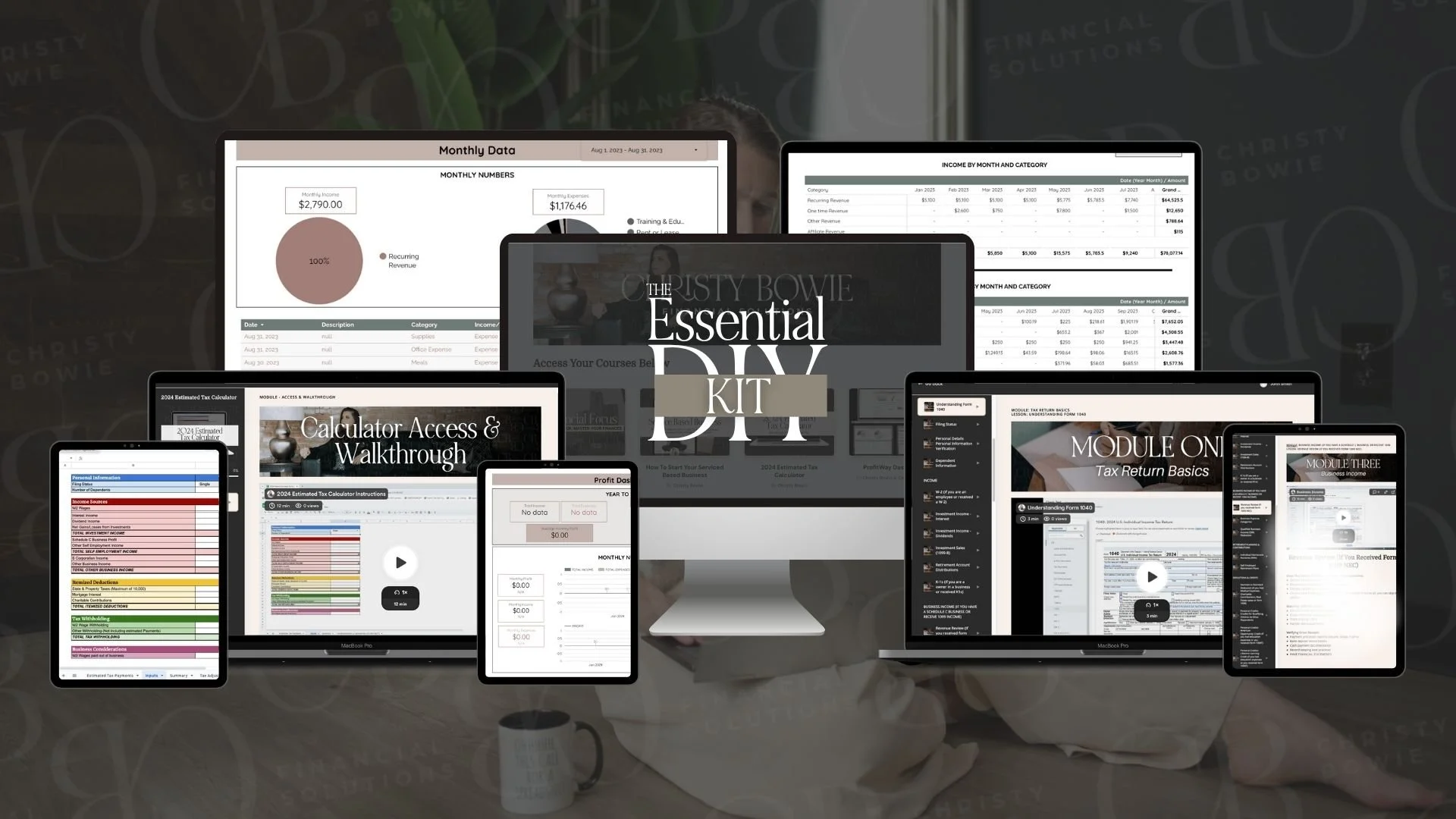

🟡 ProfitWay Dashboard – See exactly how your business is doing (without Excel-induced migraines)

🟡 Estimated Tax Calculator – Know what to save and when, so tax day doesn’t tank your bank account

🟡 Financial Focus Templates – Get your brain on paper. Track your goals. Review what matters.

Together, these small business finance tools make up the Essential DIY Kit—the no-fluff foundation I wish every founder had before things got messy.

Normally $393. Through July 31? $257 for the full bundle.

The Bottom Line

You don’t have to hire right now. You don’t have to be scaling. But you do need clarity.

Because confusion is expensive.

And even in hard seasons, you deserve to feel in control—not in the dark.

👉 Grab The Essential DIY Kit here and give your future self the gift of peace (and receipts).

More Financial Resources for CEOs:

Why Your Bank Balance Doesn't Equal Your Business Profit (And What to Track Instead)

Estimated Tax Payments For Small Business: How To Calculate Your Quarterly Payments

How to Pay Yourself First (Even When Your Revenue Fluctuates)

Disclaimer: While this guide provides valuable insights, it's important to note that every business has unique circumstances. For personalized advice tailored to your specific situation, please consult with a qualified financial professional. Our goal at CBFS is to empower you to make informed decisions that support your business growth and personal wealth-building objectives.

Want to work together? Apply here to see if we're a good fit.